Chart of the Month: May 2005

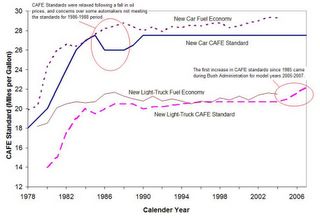

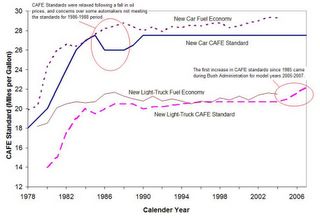

In the previous two editions of Chart of the Month, I posted charts showing the overall fuel usage of the Light-duty vehicles, and one of the reasons contributing to the increasing fuel usage, namely rising vehicle travel. I also noted that this increase in fuel usage has come about inspite of an increase in individual vehicle fuel economy being 50% more than what it was in late 1970s. This month's chart shows thirty years of Corporate Average Fuel Economy (CAFE) standards, and the corresponding new vehicle fuel economy levels.

(click on the image for a larger picture)

(click on the image for a larger picture)

As I have noted repeatedly here, debate over CAFE standards is one of the most heated debates in the energy policy domain. I will leave the technical details about CAFE out of this post, but it should be noted that CAFE standards pose a real constraint to the automobile manufactures. It is anybody's guess if fuel economy of new light-duty vehicle would have decreased if CAFE standards were withdrawn after 1985. In short, CAFE standards create a floor for fuel economy of new light-duty vehicles. This is important because much of the technology improvements in the past 25 years have been used up in improving vehicle performance rather than fuel economy. I would post a chart about this next month.

(click on the image for a larger picture)

(click on the image for a larger picture)As I have noted repeatedly here, debate over CAFE standards is one of the most heated debates in the energy policy domain. I will leave the technical details about CAFE out of this post, but it should be noted that CAFE standards pose a real constraint to the automobile manufactures. It is anybody's guess if fuel economy of new light-duty vehicle would have decreased if CAFE standards were withdrawn after 1985. In short, CAFE standards create a floor for fuel economy of new light-duty vehicles. This is important because much of the technology improvements in the past 25 years have been used up in improving vehicle performance rather than fuel economy. I would post a chart about this next month.